RBI tightens norms for lenders investing in AIFS

Why in news

The Reserve Bank of India (RBI) has issued new directives to banks and non-banking financial companies (NBFCs) regarding their investments in Alternative Investment Funds (AIFs).

Important Points

The RBI's Objective:

• The directive aims to tighten oversight and mitigate risks associated with certain investment structures, potentially preventing evergreening or other financial vulnerabilities. Financial institutions must ensure compliance by reviewing and restructuring existing investments within the given timelines.

Restrictions on Investments in AIFs with Downstream Investments

• Banks and NBFCs are prohibited from making investments in AIFs that have downstream investments, either directly or indirectly, in a debtor company of the bank. The term "debtor company" refers to any company to which the regulated entities (banks and NBFCs) currently have or previously had a loan or investment exposure within the preceding 12 months.

Addressing Evergreening Concerns

• The RBI aims to address concerns related to "evergreening" through this route. Evergreening typically involves extending new credit to borrowers to cover their interest payments on existing debts.

Regulatory Concerns on Certain Transactions

• The RBI has noted certain transactions where regulated entities substitute direct loan exposure to borrowers with indirect exposure through investments in units of AIFs. The notice suggests that such transactions may raise regulatory concerns.

Liquidation of Investments

• If a bank or NBFC is already invested in an AIF that makes a downstream investment in a debtor company, the bank must liquidate its investment in the AIF within 30 days from the date of such downstream investment or within 30 days from the date of the circular, whichever is applicable.

Provision and Capital Deduction

• If banks or NBFCs are unable to liquidate their investments within the prescribed time limit, they are required to make 100% provision on such investments. Additionally, investments by banks in the subordinated units of any AIF with a 'priority distribution model' shall be subject to full deduction from the bank or NBFC's capital funds.

Alternative Investment Funds (AIFs)

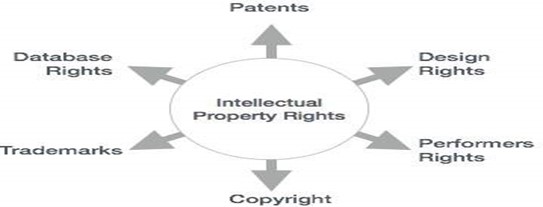

• Alternative Investment Funds (AIFs) in India are a category of pooled investment funds regulated by the Securities and Exchange Board of India (SEBI).

• AIFs are distinct from traditional mutual funds and are designed for sophisticated investors seeking higher returns and willing to take on higher risks.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)