CARBON MARKET

Why in news? :

The Parliament has passed the Energy Conservation (Amendment) Bill, 2022 in order to establish Carbon Markets in India and specify a Carbon Trading Scheme.The Bill amends the Energy Conservation Act, 2001.

What is the Energy Conservation (Amendment) Bill, 2022?

-It empowers the Centre to specify a carbon credits trading scheme.

-Under the Bill, the central government or an authorised agency will issue carbon credit certificates to companies or even individuals registered and compliant with the scheme.

-These carbon credit certificates will be tradeable in nature.

-Other persons would be able to buy carbon credit certificates on a voluntary basis.

Concerns:

Bill does not provide clarity on the mechanism to be used for the trading of carbon credit certificates— whether it will be like the cap-and-trade schemes or use another method—

Who will regulate such trading.

It is not specified, which is the right ministry to bring in a scheme of this nature,

While carbon market schemes in other jurisdictions like the U.S., United Kingdom, and Switzerland are framed by their environment ministries, the Indian Bill was tabled by the power ministry instead of the Ministry of Environment, Forest, and Climate Change (MoEFCC).

The Bill does not specify whether certificates under already existing schemes would also be interchangeable with carbon credit certificates and tradeable for reducing carbon emissions.

Two types of tradeable certificates are already issued in India— Renewable Energy Certificates (RECs) and Energy Savings Certificates (ESCs).

These are issued when companies use renewable energy or save energy, which are also activities which reduce carbon emissions.

What are Carbon Markets? :

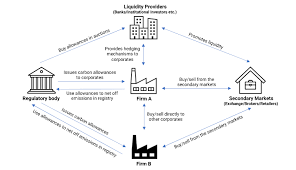

They are a tool for putting a price on carbon emissions. It allows the trade of carbon credits with the overall objective of bringing down emissions.

These markets create incentives to reduce emissions or improve energy efficiency.

For example, an industrial unit which outperforms the emission standards stands to gain credits.

Another unit which is struggling to attain the prescribed standards can buy these credits and show compliance to these standards. The unit that did better on the standards earns money by selling credits, while the buying unit is able to fulfill its operating obligations.

It establishes trading systems where carbon credits or allowances can be bought and sold.

A carbon credit is a kind of tradable permit that, per United Nations standards, equals one tonne of carbon dioxide removed, reduced, or sequestered from the atmosphere.

Carbon allowances or caps, meanwhile, are determined by countries or governments according to their emission reduction targets.

Article 6 of the Paris Agreement provides for the use of international carbon markets by countries to fulfill their NDCs (Nationally Determined Contributions).

NDCs are climate commitments by countries setting targets to achieve net-zero emissions.

Share:

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)